OIOUBL BIS Billing with Response

OIOUBL BIS Billing with Response

v3.0.0 RC

The Business Interoperability Specification,, called the “OIOUBL BIS” from here on, has been developed by the Danish Business Authority.

1. Document Structure

This document is structured as follows:

-

Chapters 1 - 3 Provides general information on the business processes, use cases and functionalities.

-

Chapter 4 Describes the primitive and semantic data types.

-

Chapter 5 Provides information about identifiers, e.g. customization and profile identifiers .

-

Chapter 6 Provides examples of selected parts of the invoice.

-

Chapter 7 Provides examples of selected parts of the invoice response.

-

Chapter 8 Statement of license and copyright.

-

Chapter 9 Link to the main site for additional documentation.

2. Parties and roles

OIOUBL BIS 3 Billing supports the following parties:

2.1. Supplier side parties

These parties are involved on the supplier’s side of the transaction, and will usually be the supplier or the supplier’s contractors.

AccountingSupplierParty: The original creditor to the claim that the invoice is presenting to the debtor. This party is the only mandatory party for the supplier side of the transaction. If the other supplier side roles are not included in the document, the creditor is deemed to fulfil these as well.

PayeeParty: The party to receive payment for the invoice, when this is not the creditor (e.g. in the case of factored invoices).

SellerSupplierParty: The party who made the sale, where this is different from the creditor. Used in cases where the seller is not the creditor, for instance because the seller is acting as an agent of the creditor.

TaxRepresentativeParty: The party responsible for creditor’s VAT compliance, provided this is not the creditor. Rarely used in Denmark.

2.2. Customer side parties

These parties are involved on the customer’s side of the transaction, and will usually be the customer or the customer’s contractors.

AccountingCustomerParty: The debtor, who has received a consideration from the seller, and is therefore liable to pay the invoiced amount. This party is the only mandatory party for the customer side of the transaction. If the other customer side roles are not included in the document, the debtor is deemed to fulfil these as well.

BuyerCustomerParty: The party who issued the purchase order, where this is different from the debtor. Used in cases where the buyer is not the debtor, for instance because the buyer is acting as an agent of the debtor.

DeliveryParty: The party to whom delivery is made, when distinct from the debtor. Note that this is distinct from the delivery location, which is a physical location where delivery takes place. The address associated with the DeliveryParty is the correspondance address for the party, not the physical location of delivery.

DeliveryParty may be specified at document or line level, depending on whether the invoice covers more than one delivery or not.

OriginatorParty: The party that requisitioned the purchase, where this is different from the buyer or debtor. Used in cases where it is important to be able to track where in the customer’s organization the purchase originated (e.g. because the originator is part of the control flow for the invoice).

OriginatorParty is specified at the invoice line level.

2.3. Logistics Parties

These parties are not involved in the transaction as such; only in the delivery of goods from supplier to customer. However, the invoice recipient may require this information, e.g. for compliance reasons or to match against a receipt they have issued for delivery of goods.

The logistics parties are associated with individual consignments, as different consignments may be shipped from different warehouses using different carriers and forwarders.

CarrierParty: The carrier employed in the delivery of goods. This is the party that actually physically moves the consignment.

FreightForwarderParty: The freight forwarder employed in the delivery. This is the party that arranges for paperwork, warehousing, etc. along the consignment’s journey, and coordinates between different carriers.

OriginalDespatchParty: The party responsible for the original despatch. Typically the operator of the warehouse from which the goods were sent.

2.4. Other parties

ManufacturerParty: The party that originally manufactured the item. May or may not be party to the actual transaction. Used when it is important to be able to identify which manufacturer a given item is sourced from (e.g. because the customer and supplier have a frame agreement with different discount schemes for different manufacturers).

Manufacturer party is specified at the item level.

IssuerParty: The party that issued a document referenced in the invoice. Usually not a party to the transaction itself, but the parties to the transaction may wish to be able to track the issuer of documents such as material safety data sheets or certificatoins of conformity.

SignatoryParty: The party issuing a digital signature included in the invoice.

One who owes debt. The party responsible for making settlement relating to a purchase. The party that receives the invoice or credit note. Also known as invoicee, accounts payable, or buyer.

3. Business Processes

3.1. General invoicing processes

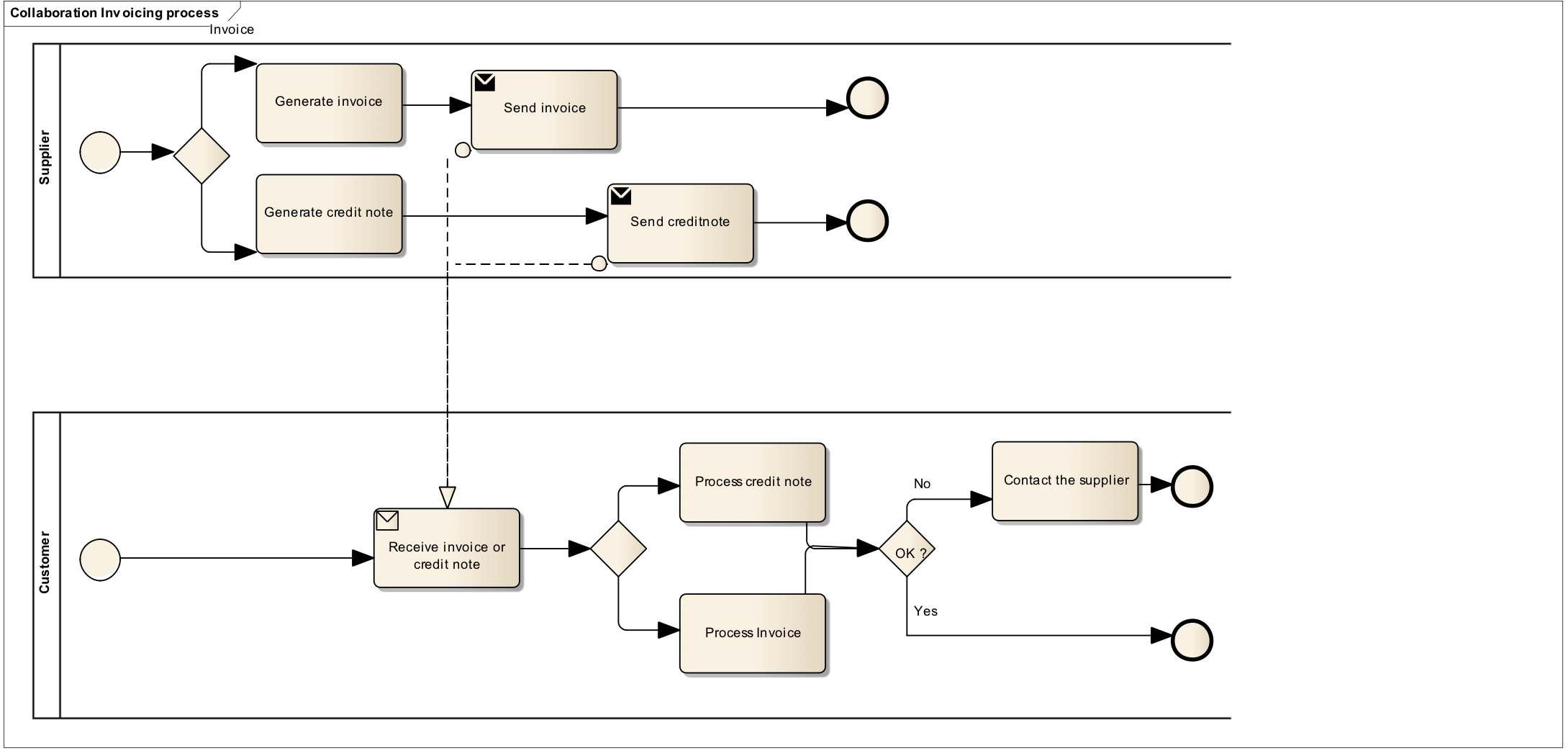

The invoicing process includes issuing and sending the invoice and the credit note from the supplier to the customer and the reception and handling of the same at the customer’s site.

The invoicing process is shown in this work flow:

-

A supplier issues and sends an invoice to a customer. The invoice refers to one or more deliveries of goods and services.

An invoice may also refer to one or more preceding orders, contracts or frame agreements. The invoice shall describe the delivered goods and services, and may reference the article numbers or manufacturer or other IDs.

-

The customer receives the invoice and processes it in their invoice control system(s), leading to one of the following results:

-

The customer fully approves the invoice, posts it in the accounting system and passes it on to be paid.

-

The customer disputes the invoice in its entirety, contacts the supplier and requests a credit note.

-

The customer disputes parts of the invoice, contacts the supplier and requests a credit note and a new invoice.

-

The diagram below shows the basic invoicing process supported by this OIOUBL BIS profile.

This profile covers the following invoice processes:

| P1 |

Invoicing of deliveries of goods and services against purchase orders, based on a contract |

| P2 |

Invoicing deliveries of goods and services based on a contract |

| P3 |

Invoicing the delivery of an incidental purchase order |

| P4 |

Pre-payment |

| P5 |

Spot payment |

| P6 |

Payment in advance of delivery |

| P7 |

Invoices with references to a despatch advice |

| P8 |

Invoices with references to a despatch advice and a receiving advice |

| P9 |

Credit notes or invoices with negative amounts, issued for a variety of reasons including the return of empty packaging |

| P10 |

Corrective invoicing (cancellation/correction of an invoice) |

| P11 |

Partial and final invoicing |

3.2. Invoice Response principles and prerequisites

This chapter describes the principles and assumptions that underlie the use of the Invoice Response. The term Invoice in this specification is used for both an invoice and a credit note unless otherwise stated in the text or clear from the context.

An Invoice Response can be used in the process of the exchange of invoices and credit notes before the parties have agreed on its settlement as paid or cancelled. It provides the Seller, as the issuer of the invoice or credit note, with information about the status of the invoice or credit note and provides the Buyer, as receiver of the invoice or credit note, with efficient means for keeping the Seller informed and maintain a secure record of their response.

3.2.1. Invoice Response message in general

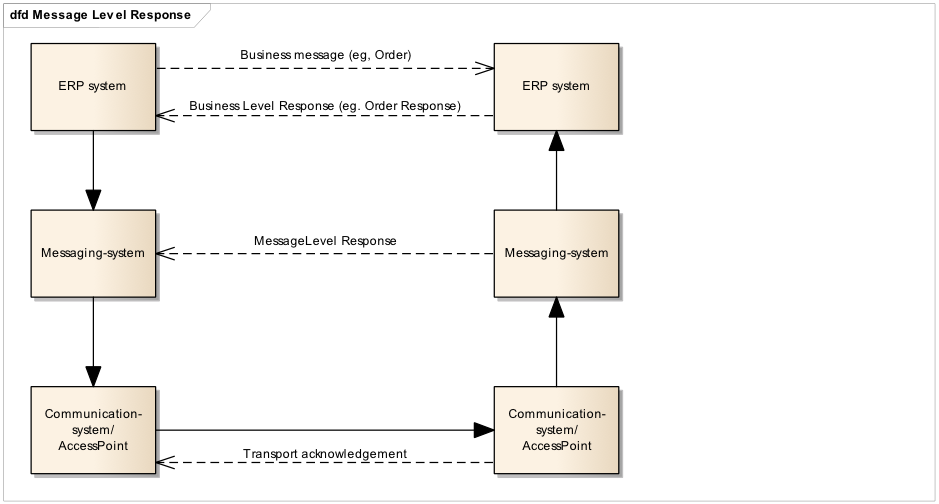

Once an electronic business document is created and passed to the recipient’s endpoint, there may be a need to inform relevant parties involved in the data exchange about the message’s status or validation results. These response types are different in nature and for the purpose of this document they can be divided into the following main groups:

Once an electronic business message is delivered to the recipient, there may be a need to inform involved parties about the message’s status or validation results. These response types are different in nature, and for the purpose of this document they can be divided into the following main groups:

Transport acknowledgement

This message is exchanged within the transport network(s), to inform on the status of a message which is being exchanged between parties. These responses may inform a counterparty about the status of a delivery (success/failure/in process), and may contain details about relevant issues, such as why a delivery was not successful. The key feature of these responses is that they do not inform on results of validation or processing of the of the payload content that is being transported. These response messages are commonly called “acks”.

Message Level Response

When a message has reached a given point in a data exchange, its content may be validated according to agreed specifications. Such specifications may be syntactical and/or semantic. The outcome of these validations may be reported to a relevant up-stream party. These outcomes include the success or failure of the validation, along with additional explanatory details on errors. An example could be an order message that is rejected after receipt, because the subtotals do not add up to the order total (syntax error), or because a free text field is used to provide information for which the BIS prescribes a specific data structure (semantic error). Message level responses do not report on the business content of the communication, only on syntactic and semantic (in)validity.

Business Level Response

A message that has been received and accepted for processing may call for an action on the receiver’s behalf. That receiver’s action may need to be reported back up-stream to a relevant party. An example is where a technically correct invoice may be received but the receiver decides to dispute the invoice for a business reason, such as incorrect values, delivery issues etc. The key feature of these responses is that they report a business decision that is made on the message instance which is received.

This specification is only concerned with the Business Level Responses, specifically in response to invoices.

3.2.2. Scope of the Invoice Response message

The Invoice Response is a response message specific to invoices and credit notes. The invoice response can be used to inform the Seller of the status of an invoice in the Buyer’s approval and payment processes.

-

Invoice Response helps the Seller to initiate an action early in the case when the processing of an invoice is challenged on the Buyer side.

-

Invoice Response informs the Seller whether his invoice is following the ordinary approval process, or that process is disrupted and requires action from Seller.

-

Invoice Response informs the Seller when their invoice has been approved or payment has been initiated, so that the Seller can manage their cash flows and monitor the reception of funds through the payment channels.

-

Invoice Response provides an automated means for the Buyer to keep the Seller informed of the invoice status in his invoice verification process, and thus reduces or eliminates the need for manual status queries.

-

Invoice Response is designed to support automatic processing on the Seller side although it still may require manual actions.

-

Invoice Response provides the structure for the feedback loop from Buyer to Seller regarding the invoice handling process on Buyer’s side.

-

Invoice Response is an option for the Buyer to inform Seller about the Buyer’s decisions when invoice processing in a structured form.

-

Invoice Reponse provides the parties with a clear record of their communication, should either party need to document this interaction at a later date.

In scope

-

Buyer can inform the Seller about Invoice and Credit Note processing steps and statuses on Buyer’s side.

-

Invoice Response is a one directional message only - from Buyer to Seller.

-

Several response messages can potentially be exchanged for one Invoice or Credit Note.

-

Invoice Response content may require manual action on Seller’s side.

-

Invoice Response supports only push message of the invoice status.

-

Invoice Response can not be automatically requested by Seller.

-

Invoice Response can acknowledge that a transmitted Invoice has been received and can be processed, or communicate an acceptance, partial acceptance or rejection.

Out of scope

-

Several statuses in one response message.

-

Full automation on Seller side – not all the errors have to be encoded.

-

Bi-directional communication – discussion on response.

-

Inquiry of the Invoice response message.

-

Transmission level status.

-

Support for attachments.

3.3. Invoice Response process and typical use cases

3.3.1. Process in general

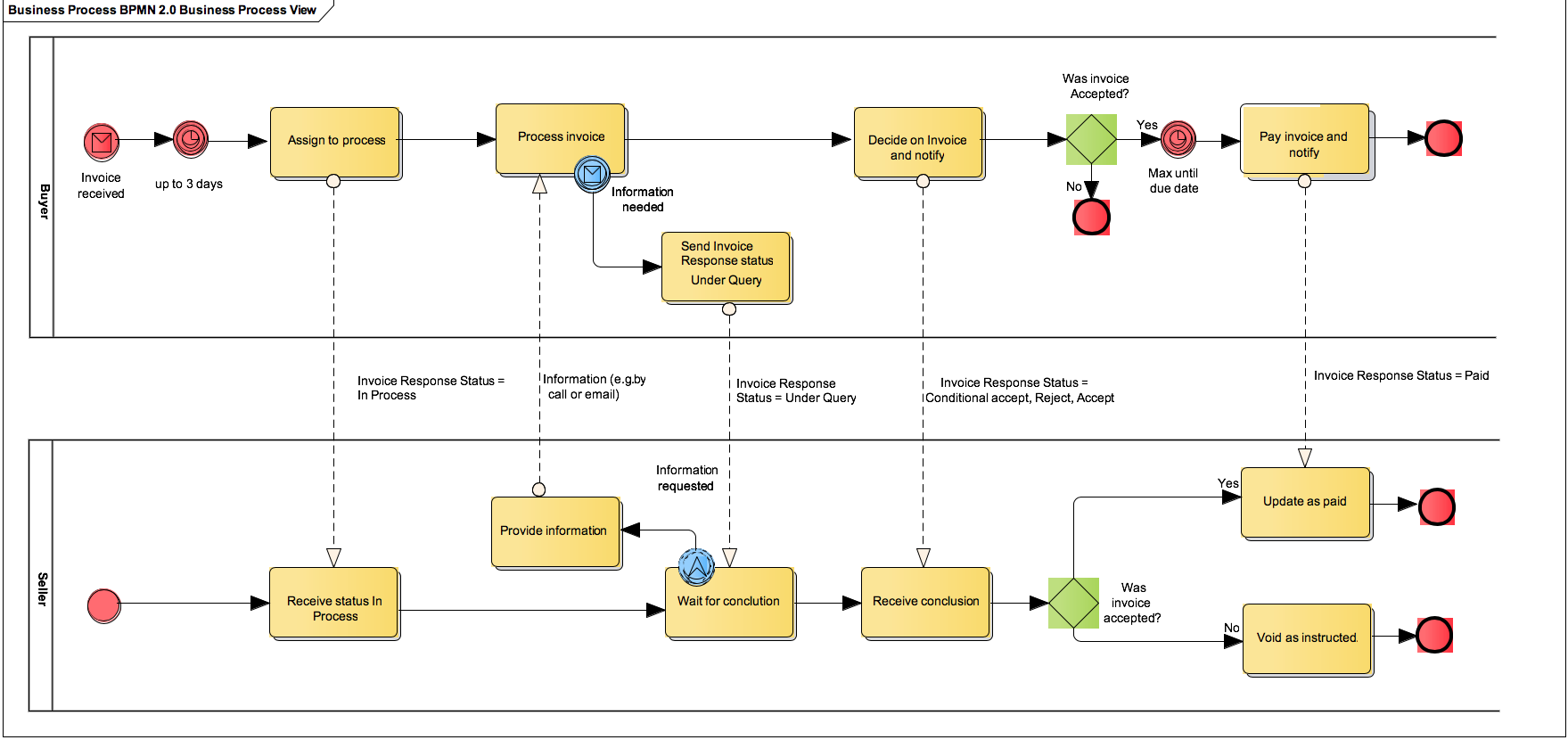

The process starts when a Seller party has sent an electronic invoice to the Buyer, and the invoice has been received without identified syntax or semantic errors.

After reception, the Buyer will usually send the invoice to the review and approval process. The approval process may result in the invoice being approved 'as is' without any comments. In this case the Buyer sends an Invoice Response to the Seller, to notify him that the invoice has been approved and will be paid on the due date. The approval process may be different for the Credit Note, which is generally not intended to result in a payment by the Buyer. However, there may still be a need or desire for the Buyer to communicate the status of the Credit Note to the Buyer (e.g. to confirm that it has been accepted, so a corrective invoice can be issued).

Alternatively, the approval process may result in various issues with the invoice being identified. Such issues could be:

-

Discrepancies between the information in the invoice and the Buyer’s records, on such matters as prices or volumes.

-

Discrepancies between the invoice terms and the terms of a binding prior agreement, e.g. wrong payment terms.

-

Invoice fails to meet invoicing requirements set by prior agreement between the parties, e.g. in the specificity of the description of goods and services delivered.

-

Invoice is for goods or services not ordered or delivered.

-

Invoice is for goods or services only partially delivered, but invoiced for the full amount.

Depending on the nature of the issues the Buyer has the following options:

-

The Buyer may put the approval process on hold and notify the Seller by sending an Invoice Response with the status 'under query' and add a further explanation of the issue(s).

-

Once the Seller has responded to the issue, the acceptance process may continue or the Buyer may raise further issues.

-

-

The Buyer may conditionally approve the invoice in which case they will send an Invoice Response to the Seller with the respective status and what the conditions are.

-

The Seller may respond outside of the electronic communication process with an objection, or they may not respond in which case the Buyer will proceed and pay the invoice according to the conditions.

-

The most common examples are when an invoice has payment terms like due date or payment account that are not in line with a contract.

-

The Buyer may notify the Seller that the invoice will be paid in accordance to the contract and then proceed to do so unless the Seller objects.

-

-

The Buyer may reject the invoice in which case the Buyer will notify the Seller and state the reason for the rejection and possibly request a Credit Note.

-

This is a final status for the invoice so if the Seller does not agree with the rejection, they must follow this up outside of the electronic communication process.

-

If an Invoice has been approved or conditionally approved the Buyer will in due time proceed to initiate payment. The Buyer may then notify the Seller that the payment has been initiated.

3.3.2. Code Policy

A key feature in an Invoice Response is to report of the status of an Invoice. The objective of the status code is to provide the Seller with a clear indication of the status of the referenced Invoice in the Buyers process in a way that clearly identifies if an action is required by the Seller. The status code can be supplemented with a clarification or an action code or textual note that explains the status and assists the Seller in deciding on the correct response.

The codes in the Invoice Response are given in the following structure.

-

Invoice Status (1..1) 'cac:DocumentResponse/Response/cbc:ResponseCode'

-

Clarification (0..n)

-

Data (0..n)

-

-

Each Invoice Response must have one and only one status code.

For each Invoice Response (status) there is the option of providing one or more clarification.

For each clarification there is the option to provide data that the Buyer proposes as a correction.

An invoice may have a status 'under query' (status UQ), as clarification the code XYZ is given to indicate that there is an issue with the references in the Invoice. For example, the information in the Invoice Response may state that the expected value for the Purchase Order reference in the Invoice was PO123.

Status codes

-

List of Status codes is fixed and can not be changed bilaterally.

-

There are seven pre-agreed status codes (main statuses).

-

Status code is sent from Buyer to Seller to inform the Seller about further processing of the invoice on Buyer side.

-

Status code does not inform the business reason for the status to the Seller (the clarification code performs this function).

-

Any status can be the first status sent to the Seller however further statuses must follow a defined order (see [invoice-response-process-rules], rule OP-BR111-R012).

-

On receipt of the first Invoice Response the Seller will know that an Invoice has been received by the Buyer and also be informed of the Invoice current status.

-

If the Seller does not receive any response, the Seller may assume that the invoice is accepted without comment.

-

Buyer and Seller may have made other bilateral arrangements regarding the coreography, for example:

-

A contractual requirement on the buyer to dispute invoices within a set number of business days

-

An obligation to positively affirm receipt or approval of an invoice, for the purpose of enabling factoring of the invoice.

-

-

Such bilateral arrangements, and their impact on the obligations of the parties, are a matter of contract law and beyond the scope of this BIS.

-

-

The minimum set of statuses that must be supported by a Buyer is 'Message acknowledged', 'Rejected' and 'Approved'.

| Status code |

The code that defines the status of the reference document, e.g. AP. |

| UNECE name |

The name of the code, based on UNECE code list 4343. |

| UNECE definition |

The definition of the code, based on UNECE code list 4343. |

| BIS usage |

An explanation of how the UNECE definition of the code shall be interpreted and applied in transactions that follow this BIS. |

| Response expected |

Indicates that the Buyer expects a response from the Seller in accordance to the information given in the Invoice Response. If no response is expected, then the Buyer will proceed with the processing of the invoice without interruption. If a response is expected, then the Buyer will not proceed with the processing until the Seller has provided the response (externally). |

| Clarification required |

Indicates that when Invoice Response message contains a 'clarification required' code, then a clarification must be provided by the Buyer in the form of a Status Reason Code (See OIOUBL 3 Kodelister) or text or both. |

| Mandatory |

Indicates that a Buyer who supports this BIS shall at minimum be able to report these statuses when processing the Invoice. In other words, the Seller can at a minimum expect to receive the status information. |

| Final |

Indicates that this is a final status when processing the referenced invoice. The Seller will not receive any further Invoice Response messages referencing this invoice. |

| Status Code | UNECE name | UNECE definition | BIS usage | Response expected | Clarification Required | Mandatory | Final |

|---|---|---|---|---|---|---|---|

AB |

Message acknowledgement |

Indicates acknowledgement that the invoice or credit note has been received and will be processed. |

Status is used when Buyer has received a readable invoice message that can be understood and submitted for processing by the Buyer. |

NO |

NO |

YES |

NO |

IP |

In Process |

Indicates that the referenced invoice or credit note is being processed. Distinct from status code AB Message Acknowledgement in that code IP In Process may contain additional clarifications. |

Status is used to inform Seller of states in Buyer’s approval flow that require no action from Seller (e.g. an internal tracking number that Seller can use in follow-up queries, the reason for a delay, or the approval step that the invoice is at). |

NO |

NO |

NO |

NO |

UQ |

Under query |

Indicates that the processing of the referenced message has been halted pending response to a query. |

Status is used when Buyer will not proceed to accept the Invoice without receiving additional information from the Seller. |

YES |

YES |

NO |

NO |

CA |

Conditionally accepted |

Indication that the invoice or credit note has been accepted under conditions indicated in this message. |

Status is used when Buyer is accepting the Invoice under conditions stated in ‘Status Reason’ and proceed to pay accordingly unless disputed by Seller. |

NO[1] |

YES |

NO |

NO |

RE |

Rejected |

Indication that the referenced invoice or credit note is not accepted. |

Status is used only when the Buyer will not process the referenced Invoice any further. |

YES |

YES |

YES |

YES |

AP |

Accepted |

Indication that the referenced invoice or credit note has been accepted. |

Status is used only when the Buyer has given a final approval of the invoice and the next step is payment |

NO |

NO |

YES |

NO |

PD with PPD (1) |

Partially Paid |

Indicates that the referenced document or transaction has been partially paid. |

Status is used together with Clarification Reason code PPD, only when the Buyer has initiated the payment of the invoice without having paid the accepted amount in full. |

NO |

NO |

NO |

NO |

PD |

Fully Paid |

Indicates that the referenced document or transaction has been paid. |

Status is used only when the Buyer has initiated the payment of the invoice. |

NO |

NO |

NO |

YES |

(1) Status code PD (Paid) together with Clarification Reason code PPD (Partially Paid) is the case when an invoice is partially paid with the intention of later paying the full invoice amount as was accepted.

The sequence of the status codes is fixed to allow the Seller, as receiver of the Invoice Response message, to advance the status of the invoice in his systems in an orderly way. See [invoice-response-process-rules]. This requires the Buyer to be conservative in reporting status and only advance an invoice when the status is reasonably certain.

The status of an invoice must advance in the following sequence, but any status may be the first one used or may be omitted.

-

AB – Message acknowledgement

-

IP – In process

-

UQ – Under query (may be repeated before moving forward)

-

CA – Conditionally accepted

-

RE – Rejected

-

AP – Accepted

-

PD – Paid, can be in steps, partially paid and then paid.

-

If an invoice is paid right after being received, the Buyer can report with a single Invoice Response using the code PD.

-

If an invoice has been put 'under query' then following the response from the Seller, the Buyer may advance it to any of the following codes:

CA conditionally accepted

RE Rejected

AP Accepted

PD Paid

Deviations from this sequence must be handled manually between the trading parties. As an example, if a Buyer has stated that an invoice has been accepted they can not later send an Invoice Response indicating that it is under query or rejected. This does not in itself prohibit the Buyer from changing the original decision (though prior agreement or general principles of contract law may), but the Buyer must report this to the Seller by other means than by using an Invoice Response.

The fixed order simplifies the automation of the processing for the receiver of the Invoice Response.

Clarification

Depending on the status code, a clarification may be needed to state the Buyer’s reason for the status and/or any expected action from the Seller’s side. The clarification may be given as text (in Status Reason) or as code (in StatusReasonCode). The purpose of the clarification is to provide the Seller with structured information which enables the Seller to partially or fully automate processing. The clarifications are of two types.

-

Reasons for the given status.

-

Actions that the Buyer requests from the Seller.

These two types of clarifications are contained in separate code lists that have different list identifiers. This allows the Seller to distinguish between the two types of clarifications. Clarification codes are defined in OIOUBL 3 Kodelister.

Similar business reasons, for example missing order number, may trigger different statuses depending on the Buyer’s business process e.g. missing order number - some Buyers might ’Reject’ the invoice but some Buyers might put it ’Under query’.

Detail type codes and values

For each clarification code the Buyer can provide details to assist in the correction. For example, if an invoice contains the wrong VAT ID for the Buyer, then the Buyer can provide the correct ID in the Invoice Response. When providing such data, it should when possible be provided in a structured format (type code), which identifies the information type and the correct value.

The detail type code for each data type shall be the EN 16931 business term identifier of the information to be corrected, and the detail value shall be the value that the Buyer proposes as the correct one.

Example:

A Buyer receives an Invoice where the following is true:

-

The Invoice complies to OIOUBL BIS Billing specification.

-

The Buyer‘s VAT ID in the invoice is incorrect and should be EU12345.

-

The Buyer requests the Seller to send a credit note to cancel the incorrect invoice and issue a new invoice with the correct VAT ID.

The EN 16931 business term identifier for the Buyers TAX number is BT-48. To inform and assist in resolving the issue the Buyer sends an Invoice Response to the Seller as follows:

| Invoice status |

RE (Rejected) |

| Clarification code |

LEG (Legal information incorrect) |

| Detail type code |

BT-48 |

| Detail value |

EU12345 |

3.3.3. Typical use cases

The following use cases demonstrate how the Invoice Response can be used in various scenarios. This list is not intended to be comprehensive; the use cases are drawn up to illustrate the general functionality.

| No | Use Case Name |

|---|---|

Invoice in process. |

|

Invoice is in process with additional reference data. |

|

Invoice is in process but postponed. |

|

Invoice is accepted. |

|

Invoice is accepted by a third party acting on behalf of the Buyer. |

|

Invoice is rejected. |

|

Invoice is rejected requesting replacement. |

|

Invoice is conditionally accepted. |

|

Invoice is under query because of wrong or missing information. |

|

Invoice is under query because of missing purchase order (PO) reference. |

|

Invoice is in under query because of wrong details, partial Credit Note requested. |

|

Invoice payment has been initiated. |

| Use Case number | 1a |

|---|---|

Use Case Name |

Invoice In Process. |

Assumption and description |

Invoice has been received, but a clear or final response is not possible within the maximum response time agreed between the Parties |

The flow |

Invoice Response with 'In Process' status prior to the agreed deadline. The final status has to be delivered later when the invoice has been fully processed. |

Parties involved |

Buyer |

Result |

Seller is notified that the invoice is being processed, and a further Invoice Response will follow. |

| Use Case number | 1b |

|---|---|

Use Case Name |

Invoice is 'In process with additional reference data'. |

Assumption and description |

The Buyer wants to inform the Seller of the date when the Buyer has received an invoice together with the Buyer’s internal reference ID for that invoice. |

The flow |

Invoice Response with 'In Process' status, including information about formal date of receipt and Buyer’s reference ID for the invoice. |

Parties involved |

Buyer |

Result |

The Seller knows that invoice is in process and that the Buyer received it on a certain date. The Seller is informed of the internal reference used by the Buyer for this invoice. |

| Use Case number | 1c |

|---|---|

Use Case Name |

Invoice is 'In process but postponed' |

Assumption and description |

Buyer informs Seller that a reference could not be validated, but a further attempt will be made to process the Invoice at a later date. No further action is required at this time. Buyer validates the invoice, but a reference number could not be matched to those on the Buyer’s system. E.g. Buyer’s invoice processing system does not show the goods received notice from Buyer’s inventory processing system. |

The flow |

Invoice Response with 'In Process' status and clarification text providing a date when invoice processing will continue/be retried. |

Parties involved |

Buyer |

Result |

Seller knows that the Invoice is in the payment queue and the process is stopped until an appointed date when a further attempt will be made to match the Invoice. |

| Use Case number | 2a |

|---|---|

Use Case Name |

Invoice is 'Accepted' |

Assumption and description |

Buyer has accepted the Invoice. |

The flow |

Invoice Response with 'Accepted' status and mandatory Invoice Response data indicating that an invoice is accepted. |

Parties involved |

Buyer |

Result |

Seller is notified that an Invoice has been accepted and will be paid by the due date. |

| Use Case number | 2b |

|---|---|

Use Case Name |

Invoice is 'Accepted by third party who acts on behalf of Buyer'. |

Assumption and description |

The Buyer has contracted a service provider to handle Invoice to Order matching on the Buyer’s behalf. |

The flow |

Invoice Response with 'Accepted' status and mandatory Invoice Response data indicating that an Invoice is accepted. Sending Party differs from Buyer party details. |

Parties involved |

Buyer |

Result |

Seller is notified that an Invoice has been accepted and will be paid on the due date. |

| Use Case number | 3a |

|---|---|

Use Case Name |

Invoice is 'Rejected' |

Assumption and description |

Buyer has rejected the invoice. Buyer does not provide any encoded reasoning for the rejection but does provide a free text description of the reason. |

The flow |

Invoice Response with 'Rejected' status and a free text rejection reason. |

Parties involved |

Buyer |

Result |

Seller is notified that an Invoice has been rejected. In case further clarifications are needed, Seller needs to contact the Buyer for further actions (externally). |

| Use Case number | 3b |

|---|---|

Use Case Name |

Invoice is 'Rejected requesting replacement'. |

Assumption and description |

Invoice is rejected. A Credit Note and a new Invoice are requested. The Buyer does not accept the invoice content and rejects it, e.g. because of missing purchase order (PO) reference. Buyer needs a Credit Note to cancel the original Invoice and a new correct Invoice to continue with processing. The Buyer provides contact data and textual reasoning. |

The flow |

Invoice Response with 'Rejected' status, explanatory clarification as text or code (e.g. missing PO reference) and instructive clarification code for issuing Credit Note and re-issuing of a new Invoice by Seller. Buyer provides contact information to the Seller. |

Parties involved |

Buyer |

Result |

The Seller has been informed that the Invoice has been rejected.

The Seller will proceed to issue a Credit Note for the referenced Invoice and a new Invoice to replace it. |

| Use Case number | 4 |

|---|---|

Use Case Name |

Invoice is 'Conditionally accepted' |

Assumption and description |

The Invoice is conditionally accepted and will be paid on a date different from the Invoice due date. The Buyer has accepted the Invoice and intends to pay it according to agreement which gives a due date different from what is stated in the invoice. |

The flow |

Invoice Response with 'Conditionally accepted' status and explanatory clarification code for changed payment terms. The clarification includes information on what date the Invoice will be paid. |

Parties involved |

Buyer |

Result |

Seller is notified that Invoice has been 'Conditionally accepted' and will be paid on a date that is different from what was stated in the Invoice. If the Seller accepts the change, the Seller does not need to react, otherwise the Seller must contact the Buyer (externally). |

| Use Case number | 5a |

|---|---|

Use Case Name |

Invoice is 'Under query because of wrong or missing information'. |

Assumption and description |

The Buyer cannot process the Invoice and needs additional data from the Seller in order to proceed. |

The flow |

An Invoice Response is sent with 'Under query' status and clarification text stating what information is missing from the Invoice.

Buyer informs of the reference date for the status. |

Parties involved |

Buyer |

Result |

Seller has been notified that data is missing from the Invoice. Seller has been notified about the date when the Invoice was put 'Under query'. Seller needs to forward the correct data to the Buyer (externally) to enable the Buyer to process the Invoice further. |

| Use Case number | 5b |

|---|---|

Use Case Name |

Invoice is 'Under query' because for example of missing purchase order (PO) reference. |

Assumption and description |

The Buyer cannot process the invoice because he requires a PO reference. Distinct from use case 5a "Under query because of wrong or missing information," because the missing information in this case is covered by a structured status code. |

The flow |

An Invoice Response is sent with 'Under query status, explanatory clarification code for missing PO reference and instructive clarification code for providing it. |

Parties involved |

Buyer |

Result |

The Seller has been notified that a PO reference is missing from the Invoice and that the Seller must provide it in order for Buyer to continue with processing. Seller’s system has the possibility to automatically identify the missing or invalid information, because an explicit code has been provided for it, rather than a free text description. |

| Use Case number | 5c |

|---|---|

Use Case Name |

Invoice is 'Under query because of incorrect details'. A partial Credit Note is requested. |

Assumption and description |

The Buyer objects to a single line on the Invoice that doesn’t correspond to the delivery and wants the Seller to issue a Credit Note for that line. |

The flow |

An Invoice Response is sent with an 'Under query’ status, clarification text for incorrect Invoice line and instructive clarification code for issuing a Credit Note. |

Parties involved |

Buyer |

Result |

Seller has been notified that the Invoice has an incorrect Invoice Line and that he needs to issue a partial Credit Note. |

| Use Case number | 6 |

|---|---|

Use Case Name |

Invoice 'Payment has been initiated' |

Assumption and description |

The Buyer indicates to the Seller that an invoice payment has been initiated. |

The flow |

An Invoice Response is sent with 'Paid' status. |

Parties involved |

Buyer |

Result |

Seller knows that the payment will be received before long. |

4. Invoice functionality

4.1. Calculation

4.1.1. Calculation of totals

Formulas for the calculations of totals are as follows:

| Business term id | Term name | Calculation |

|---|---|---|

BT-106 |

Sum of invoice line net amounts |

\$sum("BT-131: Invoice line net amount")\$ |

BT-107 |

Sum of allowances on document level |

\$sum("BT-92: Document level allowance amount")\$ |

BT-108 |

Sum of charges on document level |

\$sum("BT-99: Document level charge amount")\$ |

BT-109 |

Invoice total amount without VAT |

\$\ \ \ \ "BT-106: Sum of invoice line net amounts"\$ |

BT-110 |

Invoice total VAT amount |

\$sum("BT-117: VAT category tax amount")\$ |

BT-112 |

Invoice total amount with VAT |

\$\ \ \ \ "BT-109: Invoice total amount without VAT"\$ |

BT-115 |

Amount due for payment |

\$\ \ \ \ "BT-112: Invoice total amount with VAT"\$ |

UBL syntax calculation formulas

The following elements show the legal monetary totals for an Invoice or Credit Note

| Element | Formula |

|---|---|

<cbc:LineExtensionAmount> |

\$sum("cac:InvoiceLine/cbc:LineExtensionAmount")\$ |

<cbc:AllowanceTotalAmount> |

\$sum("cac:AllowanceCharge[ChargeIndicator='false']/cbc:Amount")\$ |

<cbc:ChargeTotalAmount> |

\$sum("cac:AllowanceCharge[ChargeIndicator='true']/cbc:Amount")\$ |

<cbc:TaxExclusiveAmount> |

\$\ \ \ \ "cac:LegalMonetaryTotal/cbc:LineExtensionAmount"\$ |

<cbc:TaxInclusiveAmount> |

\$\ \ \ \ "cac:LegalMonetaryTotal/cbc:TaxExclusiveAmount"\$ |

<cbc:PrepaidAmount> |

Not applicable |

<cbc:PayableRoundingAmount> |

Not applicable |

<cbc:PayableAmount> |

\$\ \ \ \ "cac:LegalMonetaryTotal/cbc:TaxInclusiveAmount"\$ |

Element for rounding amount, the PayableRoundingAmount

It is possible to round the expected payable amount.

The element cac:LegalMonetaryTotal/cbc:PayableRoundingAmount is used for this purpose and is specified on the header level. This value shall be added to the value in: cac:LegalMonetaryTotal/cbc:PayableAmount.

Example: Amount 999.81 rounded to 1000. PayableRounding Amount = 0.19

4.1.2. Calculation on line level

Item net price (BT-146)

If gross price and discount exist, the Item net price has to equal with the item gross price less the item price discount.

Calculation formula:

\$"Item net price" = "Item gross price (BT-148)" - "Item price discount (BT-147)"\$

<cac:Price>

<cbc:PriceAmount currencyID="DKK">410</cbc:PriceAmount>(3)

<cbc:BaseQuantity unitCode="XPK">1</cbc:BaseQuantity>

<cac:AllowanceCharge>

<cbc:ChargeIndicator>false</cbc:ChargeIndicator>

<cbc:Amount currencyID="DKK">40</cbc:Amount>(2)

<cbc:BaseAmount currencyID="DKK">450</cbc:BaseAmount>(1)

</cac:AllowanceCharge>

</cac:Price>| 1 | Item gross price |

| 2 | Item price discount |

| 3 | \$"Item price net amount" = "Item gross price" - "Item price discount"\$ |

Invoice line net amount (BT-131)

The invoice line net amount (BT-131) is as the name implies the net amount without VAT and inclusive of line level allowance and charges.

The formula for calculating the invoice line net amount is:

\$"Item line net amount" = (("Item net price (BT-146)" div "Item price base quantity (BT-149)")\$

\$times ("Invoiced Quantity (BT-129)")\$

\$+ "Invoice line charge amount (BT-141)" - "Invoice line allowance amount (BT-136)"\$

|

As the line net amount must be rounded to two decimals, please note that the different parts of the calculation must be rounded separately. I.e the result of \$"Item line net amount" = (("Item net price (BT-146)" div "Item price base quantity (BT-149)") times ("Invoiced Quantity (BT-129)")\$ must be rounded to two decimals, and the allowance/charge amounts are also rounded separately. |

<cbc:InvoicedQuantity unitCode="XPK">10</cbc:InvoicedQuantity>(3)

<cbc:LineExtensionAmount currencyID="DKK">1000.00</cbc:LineExtensionAmount>(4)

<!-- Code omitted for clarity-->

<cac:Price>

<cbc:PriceAmount currencyID="DKK">200</cbc:PriceAmount>(1)

<cbc:BaseQuantity unitCode="XPK">2</cbc:BaseQuantity>(2)

</cac:Price>| 1 | Item net price |

| 2 | Item price base quantity |

| 3 | Invoiced quantity |

| 4 | \$"Invoice line net amount" = (("Item net price" div "Item price base quantity") times ("Invoiced Quantity")\$ |

<cbc:InvoicedQuantity unitCode="XPK">10</cbc:InvoicedQuantity>(4)

<cbc:LineExtensionAmount currencyID="DKK">900.00</cbc:LineExtensionAmount>(5)

<!-- Code omitted for clarity-->

<cac:AllowanceCharge>

<cbc:ChargeIndicator>true</cbc:ChargeIndicator>

<cbc:AllowanceChargeReasonCode>CG</cbc:AllowanceChargeReasonCode>

<cbc:AllowanceChargeReason>Charge</cbc:AllowanceChargeReason>

<cbc:MultiplierFactorNumeric>1</cbc:MultiplierFactorNumeric>

<cbc:Amount currencyID="DKK">1</cbc:Amount>(2)

<cbc:BaseAmount currencyID="DKK">100</cbc:BaseAmount>

</cac:AllowanceCharge>

<cac:AllowanceCharge>

<cbc:ChargeIndicator>false</cbc:ChargeIndicator>

<cbc:AllowanceChargeReasonCode>95</cbc:AllowanceChargeReasonCode>

<cbc:AllowanceChargeReason>Discount</cbc:AllowanceChargeReason>

<cbc:Amount currencyID="DKK">101</cbc:Amount>(3)

</cac:AllowanceCharge>

<!-- Code omitted for clarity-->

<cac:TaxTotal>

<cbc:TaxAmount currencyID="DKK">225.00</cbc:TaxAmount>

<cac:TaxSubtotal>

<cbc:TaxableAmount currencyID="DKK">900.00</cbc:TaxableAmount>

<cbc:TaxAmount currencyID="DKK">225.00</cbc:TaxAmount>

<cac:TaxCategory>

<cbc:ID>S</cbc:ID>

<cbc:Percent>25</cbc:Percent>

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID>

</cac:TaxScheme>

</cac:TaxCategory>

</cac:TaxSubtotal>

</cac:TaxTotal>

<cac:Price>

<cbc:PriceAmount currencyID="DKK">100</cbc:PriceAmount>(1)

</cac:Price>| 1 | Item net price |

| 2 | Line charge amounts |

| 3 | Line allowance amount |

| 4 | Invoiced quantity |

| 5 | \$"Invoice line net amount" = ("Item net price" times "Invoiced Quantity") + "line charge amount" - "line allowance amount"\$ |

4.1.3. Calculation of allowance/charge amount

Allowance and charge on document and line level consists of elements carrying information on the allowance/charge base amount and the allowance/charge percentage. These are, if present in the invoice instance, used for calculating the allowance/charge amount.

If base amount is present, the percentage shall also be present, and if percentage is present, the base amount shall also be present, and the calculation of the amount shall be:

\$"Amount" = "Base amount" times ("Percentage" div 100)\$

<cac:AllowanceCharge>

<cbc:ChargeIndicator>true</cbc:ChargeIndicator>

<cbc:AllowanceChargeReasonCode>CG</cbc:AllowanceChargeReasonCode>

<cbc:AllowanceChargeReason>Cleaning</cbc:AllowanceChargeReason>

<cbc:MultiplierFactorNumeric>20</cbc:MultiplierFactorNumeric>(2)

<cbc:Amount currencyID="DKK">200</cbc:Amount> (3)

<cbc:BaseAmount currencyID="DKK">1000</cbc:BaseAmount>(1)

<cac:TaxCategory>

<cbc:ID>S</cbc:ID>

<cbc:Percent>25</cbc:Percent>

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID>

</cac:TaxScheme>

</cac:TaxCategory>

</cac:AllowanceCharge>| 1 | Base amount, to be used with the percentage to calculate the amount |

| 2 | Charge percentage |

| 3 | \$"Base amount" times ("Percentage" div 100) = "Amount"\$ |

<cac:AllowanceCharge>

<cbc:ChargeIndicator>false</cbc:ChargeIndicator>

<cbc:AllowanceChargeReasonCode>95</cbc:AllowanceChargeReasonCode>

<cbc:AllowanceChargeReason>Discount</cbc:AllowanceChargeReason>

<cbc:Amount currencyID="DKK">200</cbc:Amount>(1)

<cac:TaxCategory>

<cbc:ID>S</cbc:ID>

<cbc:Percent>25</cbc:Percent>

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID>

</cac:TaxScheme>

</cac:TaxCategory>

</cac:AllowanceCharge>| 1 | Amount of allowance without calculations based on base amount and percentage |

4.1.4. Calculation of VAT

One VAT Breakdown shall be provided for each distinct combination of VAT category code and VAT rate found in either the line VAT information or the Document level allowance or charges.

For each distinct combination of VAT category code and VAT rate the calculations are:

\$"VAT category taxable amount (BT-116)" = sum("Invoice line net amounts (BT-131)")\$

\$+ "Document level charge amount (BT-99)" - "Document level allowance amount (BT-92)"\$

\$"VAT category tax amount (BT-117)" = "VAT category taxable amount (BT-116)" times ("VAT rate (BT-119)" div 100)\$

| For VAT Breakdown where the VAT Category is "Not subject to VAT" (O), the VAT category tax amount shall be zero. |

<cac:AllowanceCharge>

<cbc:ChargeIndicator>true</cbc:ChargeIndicator>

<cbc:AllowanceChargeReason>Cleaning</cbc:AllowanceChargeReason>

<cbc:Amount currencyID="DKK">200</cbc:Amount>(1)

<cac:TaxCategory>

<cbc:ID>S</cbc:ID>

<cbc:Percent>25</cbc:Percent>

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID>

</cac:TaxScheme>

</cac:TaxCategory>

</cac:AllowanceCharge>

<cac:AllowanceCharge>

<cbc:ChargeIndicator>false</cbc:ChargeIndicator>

<cbc:AllowanceChargeReason>Discount</cbc:AllowanceChargeReason>

<cbc:Amount currencyID="DKK">100</cbc:Amount>(2)

<cac:TaxCategory>

<cbc:ID>S</cbc:ID>

<cbc:Percent>25</cbc:Percent>

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID>

</cac:TaxScheme>

</cac:TaxCategory>

</cac:AllowanceCharge>

<cac:TaxTotal>

<cbc:TaxAmount currencyID="DKK">1250.00</cbc:TaxAmount>

<cac:TaxSubtotal>(3)

<cbc:TaxableAmount currencyID="DKK">5000.0</cbc:TaxableAmount>(4)

<cbc:TaxAmount currencyID="DKK">1250</cbc:TaxAmount>(5)

<cac:TaxCategory>

<cbc:ID>S</cbc:ID>

<cbc:Percent>25</cbc:Percent>

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID>

</cac:TaxScheme>

</cac:TaxCategory>

</cac:TaxSubtotal>

<cac:TaxSubtotal>(6)

<cbc:TaxableAmount currencyID="DKK">2000.0</cbc:TaxableAmount>

<cbc:TaxAmount currencyID="DKK">0</cbc:TaxAmount>

<cac:TaxCategory>

<cbc:ID>E</cbc:ID>

<cbc:Percent>0</cbc:Percent>

<cbc:TaxExemptionReason>Reason for tax exempt</cbc:TaxExemptionReason>

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID>

</cac:TaxScheme>

</cac:TaxCategory>

</cac:TaxSubtotal>

</cac:TaxTotal>

<cac:InvoiceLine>

<cbc:ID>1</cbc:ID>

<cbc:Note>Testing note on line level</cbc:Note>

<cbc:InvoicedQuantity unitCode="C62">10</cbc:InvoicedQuantity>

<cbc:LineExtensionAmount currencyID="DKK">4000.00</cbc:LineExtensionAmount>

<!-- code omitted for clarity -->

<cac:ClassifiedTaxCategory>

<cbc:ID>S</cbc:ID>

<cbc:Percent>25.0</cbc:Percent>

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID>

</cac:TaxScheme>

</cac:ClassifiedTaxCategory>

<cac:InvoiceLine>

<cbc:ID>2</cbc:ID>

<cbc:InvoicedQuantity unitCode="C62">10</cbc:InvoicedQuantity>

<cbc:LineExtensionAmount currencyID="DKK">2000.00</cbc:LineExtensionAmount>

<!-- code omitted for clarity -->

<cac:ClassifiedTaxCategory>

<cbc:ID>E</cbc:ID>

<cbc:Percent>0.0</cbc:Percent>

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID>

</cac:TaxScheme>

</cac:ClassifiedTaxCategory>

<cac:InvoiceLine>

<cbc:ID>3</cbc:ID>

<cbc:InvoicedQuantity unitCode="C62">10</cbc:InvoicedQuantity>

<cbc:LineExtensionAmount currencyID="DKK">900.00</cbc:LineExtensionAmount>

<!-- code omitted for clarity -->

<cac:ClassifiedTaxCategory>

<cbc:ID>S</cbc:ID>

<cbc:Percent>25.0</cbc:Percent>

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID>

</cac:TaxScheme>

</cac:ClassifiedTaxCategory>| 1 | Document level charge amount for category S and rate 25% |

| 2 | Document level allowance amount for category S and rate 25% |

| 3 | VAT Breakdown for category S and rate = 25% |

| 4 | Taxable amount = sum of line amount (line 1 and 3), plus charge amount minus allowance amount where category = S and rate = 25% |

| 5 | \$"Tax Amount" = "Taxable amount" times ("VAT rate" div 100)\$ |

| 6 | VAT Breakdown for category E, and rate = 0% |

4.2. Value added tax (VAT)

The chapters below describe the different VAT informations that can be provided in an Invoice or Credit Note.

Please also see [VAT category codes] for details on the VAT category code list, and Calculation of VAT for detailed explanation and example on how to perform the calculations for VAT Breakdown.

4.2.1. Line VAT Information

Each invoice line shall have the invoiced item VAT category code (BT-151), and for all VAT categories except "Not subject to VAT" (O), the VAT rate shall be provided.

4.2.2. Document level allowance or charge

Each document level charge or allowance must have the Document level allowance or charge VAT category code (BT-95 and BT-102), and for all VAT categories except "Not subject to VAT" (O), the VAT rate shall be provided.

4.2.3. VAT Breakdown

One VAT Breakdown shall be provided for each distinct combination of VAT category code and VAT rate found in either the line VAT information or the Document level allowance or charges. For some VAT categories, the VAT rate shall be zero, and hence the rate is not needed in order to group the VAT Breakdown for these.

Please note that for the VAT rate, only significant decimals should be considered, i.e any difference in trailing zeros should not result in different VAT breakdowns.

Invoice line 1 has category code = S and VAT rate = 25

Invoice line 2 has category code = S and VAT rate = 25.00

This should result in only one VAT Breakdown.

4.3. Rounding

To minimize the risk of differences due to rounding, the following rules apply:

|

Please also see Calculation for details on how to calculate the different amounts. = Shared rules for invoice and credit note

Unless specifically noted, the same rules apply for both invoices and credit notes. In OIOUBL 3, the differences are mostly naming conventions for certain fields and subclasses (e.g. InvoiceLine vs. CreditNoteLine) and some code lists (e.g. document type codes where valid InvoiceTypeCode and CreditNoteTypeCode values are different subsets of the master document type code list).

4.4. Negative invoices and credit notes are not allowed in OIOUBL 3

The European standard EN 16931 is a common description of both Invoices and Credit Notes, and EN 16931 allows Invoice and Credit Note documents to end up having a negative total “Amount due for payment.” If, for instance, an Invoice has a negative line due to goods returned.

OIOUBL 3 imposes a restriction on this: In OIOUBL 3, both Invoice and Credit Note must have non-negative total “Amount due for payment.” If there is a business need for a negative invoice, the invoice should be re-cast as a credit note instead. The shared rules for invoice and credit note should make this a painless process.

The function of crediting or debiting is controlled by the business document type (e.g. InvoiceTypeCode=380 vs. CreditNoteTypeCode=381) while the representation of the amount, including its sign, is not affected.

4.4.1. Example of usage of invoice and credit note

In this example, the Buyer has rejected an invoice and the Seller has agreed that a credit note must be issued to cancel the invoice, and a corrective invoice issued. For brevity the corrected invoice is not shown, only the erroneous invoice and the credit note that cancels it.

<cbc:InvoiceTypeCode>380</cbc:InvoiceTypeCode>

<!-- Code omitted for clarity -->

<cac:AllowanceCharge>

<cbc:ChargeIndicator>true</cbc:ChargeIndicator>

<cbc:AllowanceChargeReason>Insurance</cbc:AllowanceChargeReason>

<cbc:Amount currencyID="DKK">25</cbc:Amount>(1)

<cac:TaxCategory>

<cbc:ID>S</cbc:ID>

<cbc:Percent>25.0</cbc:Percent>

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID>

</cac:TaxScheme>

</cac:TaxCategory>

</cac:AllowanceCharge>

<!-- Code omitted for clarity -->

<cac:LegalMonetaryTotal>

<cbc:LineExtensionAmount currencyID="DKK">1300</cbc:LineExtensionAmount>

<cbc:TaxExclusiveAmount currencyID="DKK">1325</cbc:TaxExclusiveAmount>

<cbc:TaxInclusiveAmount currencyID="DKK">1656.25</cbc:TaxInclusiveAmount>

<cbc:ChargeTotalAmount currencyID="DKK">25</cbc:ChargeTotalAmount>

<cbc:PayableAmount currencyID="DKK">1656.25</cbc:PayableAmount>

</cac:LegalMonetaryTotal>

<cac:InvoiceLine>

<cbc:ID>1</cbc:ID>(2)

<cbc:InvoicedQuantity unitCode="DAY">7</cbc:InvoicedQuantity>

<cbc:LineExtensionAmount currencyID= "DKK">2800</cbc:LineExtensionAmount>

<!-- Code omitted for clarity -->

<cac:Price>

<cbc:PriceAmount currencyID="DKK">400</cbc:PriceAmount>

</cac:Price>

<cac:InvoiceLine>

<cbc:ID>2</cbc:ID>(3)

<cbc:InvoicedQuantity unitCode="DAY">-3</cbc:InvoicedQuantity>

<cbc:LineExtensionAmount currencyID="DKK">-1500</cbc:LineExtensionAmount>

<!-- Code omitted for clarity -->

<cac:Price>

<cbc:PriceAmount currencyID="DKK">500</cbc:PriceAmount>

</cac:Price>| 1 | Charge amount |

| 2 | Invoice line 1 with positive quantity and line amount |

| 3 | Invoice line 2 with negative quantity and line amount |

<cbc:CreditNoteTypeCode>381</cbc:CreditNoteTypeCode>(1)

<!-- Code omitted for clarity -->

<cac:AllowanceCharge>

<cbc:ChargeIndicator>true</cbc:ChargeIndicator>

<cbc:AllowanceChargeReason>Insurance</cbc:AllowanceChargeReason>

<cbc:Amount currencyID="DKK">25</cbc:Amount>(2)

<cac:TaxCategory>

<cbc:ID>S</cbc:ID>

<cbc:Percent>25.0</cbc:Percent>

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID>

</cac:TaxScheme>

</cac:TaxCategory>

</cac:AllowanceCharge>

<cac:LegalMonetaryTotal>

<cbc:LineExtensionAmount currencyID="DKK">1300</cbc:LineExtensionAmount>

<cbc:TaxExclusiveAmount currencyID="DKK">1325</cbc:TaxExclusiveAmount>

<cbc:TaxInclusiveAmount currencyID="DKK">1656.25</cbc:TaxInclusiveAmount>

<cbc:ChargeTotalAmount currencyID="DKK">25</cbc:ChargeTotalAmount>

<cbc:PayableAmount currencyID="DKK">1656.25</cbc:PayableAmount>

</cac:LegalMonetaryTotal>

<cac:CreditNoteLine>

<cbc:ID>1</cbc:ID>(3)

<cbc:CreditedQuantity unitCode="DAY">7</cbc:CreditedQuantity>

<cbc:LineExtensionAmount currencyID= "DKK">2800</cbc:LineExtensionAmount>

<!-- Code omitted for clarity -->

<cac:Price>

<cbc:PriceAmount currencyID="DKK">400</cbc:PriceAmount>

</cac:Price>

<cac:CreditNoteLine>

<cbc:ID>2</cbc:ID>(4)

<cbc:CreditedQuantity unitCode="DAY">-3</cbc:CreditedQuantity>

<cbc:LineExtensionAmount currencyID="DKK">-1500</cbc:LineExtensionAmount>

<!-- Code omitted for clarity -->

<cac:Price>

<cbc:PriceAmount currencyID="DKK">500</cbc:PriceAmount>

</cac:Price>| 1 | Code 381 indicating a credit note |

| 2 | Charge amount |

| 3 | Invoice line 1 with positive quantity and line amount |

| 4 | Invoice line 2 with negative quantity and line amount |

5. Data types

Semantic data types are used to bridge the gap between the semantic concepts expressed by the information elements and the technical implementation. The semantic data types define the allowed value domain for the content and any additional information components (attributes) needed in order to ensure a precise interpretation of the content.

5.1. Primitive types

Semantic data type content may be of the following primitive types. These primitive types were taken from ISO 15000-5:2014, Annex A.

| Primitive type | Definition |

|---|---|

Binary |

A set of finite-length sequences of binary digits. |

Date |

Time point representing a calendar day on a time scale consisting of an origin and a succession of calendar ISO 8601:2004. |

Decimal |

A subset of the real numbers, which can be represented by decimal numerals. |

String |

A finite sequence of characters. |

5.2. Semantic data types

The different semantic data types are described in the tables below, where various features such as attributes, format, and decimals as well as the basic type are defined for each semantic data type. They are based on ISO 15000-5:2014.

When used in an instance of an Invoice, each data element will contain data. In the below tables this is identified as the “content”. Whenever a business term is used this term shall always have content and therefore the content is always mandatory.

5.2.1. Amount

An amount states a numerical monetary value. The currency of the amount is defined as a separate business term.

| Amount is floating up to two fraction digits. |

| Component | Use | Primitive Type | Example |

|---|---|---|---|

Content |

Mandatory |

Decimal |

10000.25 |

5.2.2. Unit Price Amount

A unit price amount states a numerical monetary amount value for data elements that contain item prices that may be multiplied by item quantities. The currency of the amount is defined as a separate business term.

| Unit price amount does not set restrictions on number of decimals, as contrast to the Amount type |

| Component | Use | Primitive Type | Example |

|---|---|---|---|

Content |

Mandatory |

Decimal |

10000.1234 |

5.2.3. Percentage

Percentages are given as fractions of a hundred (per cent) e.g. the value 34.78 % in percentage terms is given as 34.78.

| No restriction on number of decimals for percentages. |

| Component | Use | Primitive Type | Example |

|---|---|---|---|

Content |

Mandatory |

Decimal |

34.7812 |

5.2.4. Quantity

Quantities are used to state a number of units such as for items. The code for the Unit of Measure is defined as a separate business term.

| No restriction on number of decimals for quantities. |

| Component | Use | Primitive Type | Example |

|---|---|---|---|

Content |

Mandatory |

Decimal |

10000.1234 |

5.2.5. Code

Codes are used to specify allowed values in elements as well as for lists of options. Code is different from Identifier in that allowed values have standardized meanings that can be known by the recipient.

| Codes shall be entered exactly as shown in the selected code list of the applicable syntax. |

| Component | Use | Primitive Type | Example |

|---|---|---|---|

Content |

Mandatory |

String |

Abc123 |

5.2.6. Identifier

Identifiers (IDs) are keys that are issued by the sender or recipient of a document or by a third party.

| The use of the attributes is specified for each information element. |

| Component | Use | Primitive Type | Example |

|---|---|---|---|

Content |

Mandatory |

String |

abc:123-DEF |

Scheme identifier |

Conditional |

String |

0088 |

Scheme version identifier |

Conditional |

String |

1.0 |

5.2.7. Date

Dates shall be in accordance to the “Calendar date complete representation” as specified by ISO 8601:2004, format YYYY-MM-DD.

| Dates shall not include time zone information. |

| Component | Use | Primitive Type | Example |

|---|---|---|---|

Content |

Mandatory |

Date |

2024-12-01 |

5.2.8. Time

Time shall be in accordance to the “Extended time format” as specified by ISO 8601:2004, format [hh]:[mm]:[ss].

| Time shall not include time zone information. Decimal fraction on seconds SHALL not be used. |

| Component | Use | Primitive Type | Example |

|---|---|---|---|

Content |

Mandatory |

Time |

09:30:12 |

5.2.9. Document Reference

Document Reference Types are identifiers that were assigned to a document or document line by the Buyer, the Seller or by a third party.

| Component | Use | Primitive Type | Example |

|---|---|---|---|

Content |

Mandatory |

String |

abc:123-DEF |

5.2.10. Short String

Text is the actual wording of anything written or printed. Line breaks in the text must not be present. Maximum length of short string is 64 characters.

| Component | Use | Primitive Type | Example |

|---|---|---|---|

Content |

Mandatory |

String |

Product Name |

5.2.11. Long String

Text is the actual wording of anything written or printed. Line breaks in the text may be present, and any line breaks should be preserved and respected by the receiver’s system. Maximum length of short string is 1024 characters.

| Component | Use | Primitive Type | Example |

|---|---|---|---|

Content |

Mandatory |

String |

5% allowance when paid within 30 days |

5.2.12. Text

Text is the actual wording of anything written or printed. Line breaks in the text may be present, and any line breaks should be preserved and respected by the receiver’s system

| Component | Use | Primitive Type | Example |

|---|---|---|---|

Content |

Mandatory |

String |

5% allowance when paid within 30 days |

5.2.13. Binary objects

Binary objects can be used to describe files which are transmitted together with the Invoice. The attachment functionality is not intended for of including a copy of the invoice in an image format (such as PDF). Attaching an invoice copy is not in compliance with this specification.

Attachments shall be transmitted together with the Invoice. The binary object has two supplementary components: a Mime Code, which specifies the Mime type of the attachment and a Filename that is provided by (or on behalf of) the sender of the invoice or credit note.

| Component | Use | Primitive Type | Example |

|---|---|---|---|

Content |

Mandatory |

Binary |

QmFzZTY0IGNvbnRlbnQgZXhhbXBsZQ== |

Mime Code |

Mandatory |

String |

image/jpeg |

Filename |

Mandatory |

String |

drawing5.jpg |

A receiver of an invoice or credit note, shall accept and process attachments that are according to the MimeCode code list [oioubl3-link-codelist]

6. OIOUBL 3 Identifiers

OIOUBL 3 requires the use of identifiers in both the Nemhandel eDelivery transport infrastructure and within the documents exchanged across that infrastructure. The policies that apply to this OIOUBL 3 BIS are:

6.1. Profiles and messages

All messages contain ProfileID and CustomizationID. ProfileID identifies what business process a given message is part of, and CustomizationID identifies the kind of message and the rules which are applied.

Profiles are connected to one business process, and may contain multiple document types. Valid document instances shall contain corresponding ProfileID and CustomizationID.

6.2. Customization and Profile identifiers

In the table below you will find the values to be used as the specification identifier and the business process type for this profile

| Type | Element cbc:CustomizationID |

Element cbc:ProfileID |

|---|---|---|

Invoice |

|

|

Credit Note |

|

|

Invoice Response |

|

|

Personal Invoice |

|

|

Personal Credit Note |

|

6.3. Namespaces

All document types in OIOUBL BIS Billing with Response are bound to the UBL 2.1. The target namespaces are:

| Type | Namespace |

|---|---|

Invoice and Personal Invoice |

|

Credit Note and Personal Credit Note |

|

Invoice Response |

|

7. Descriptions and Examples of Selected Elements of the Invoice and the Credit Note

In the subchapters below you find examples of selected elements of the transaction.

| This list is not intended to be exhaustive, but rather to showcase elements of particular importance or for which disambiguation is required. For the full list of supported elements, please refer to the syntax documentation. |

7.1. Parties

The following roles may be specified. The same actor may play more than one role depending on the handling routine.

Further details on the roles/actors can be found in Parties and roles.

7.2. Seller (AccountingSupplierParty)

Seller is mandatory information and provided in element cac:AccountingSupplierParty

<cac:AccountingSupplierParty>

<cac:Party>

<cbc:EndpointID schemeID="0088">7300010000001</cbc:EndpointID>

(1)

<cac:PartyIdentification>

<cbc:ID schemeID="0088">7300010000001</cbc:ID>

(2)

</cac:PartyIdentification>

<cac:PartyName>

<cbc:Name>SupplierTradingName Ltd.</cbc:Name>

</cac:PartyName>

<cac:PostalAddress>

<cbc:StreetName>Main street</cbc:StreetName>

<cbc:AdditionalStreetName>Postbox 123</cbc:AdditionalStreetName>

<cbc:BuildingNumber>1</cbc:BuildingNumber>

<cbc:CityName>London</cbc:CityName>

<cbc:PostalZone>GB 123 EW</cbc:PostalZone>

<cbc:CountrySubentity>West London district</cbc:CountrySubentity>

<cac:AddressLine>

<cbc:Line>Third address line</cbc:Line>

</cac:AddressLine>

<cac:Country>

<cbc:IdentificationCode>GB</cbc:IdentificationCode>

</cac:Country>

</cac:PostalAddress>

<cac:PartyTaxScheme>

<cbc:CompanyID schemeID="ZZZ">GB76576657</cbc:CompanyID>

(3)

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID>

</cac:TaxScheme>

</cac:PartyTaxScheme>

<cac:PartyTaxScheme>

<cbc:CompanyID schemeID="ZZZ">TaxRegistrationID</cbc:CompanyID>

<cac:TaxScheme>

<cbc:ID>TAX</cbc:ID>

</cac:TaxScheme>

</cac:PartyTaxScheme>

<cac:PartyLegalEntity>

<cbc:RegistrationName>SupplierOfficialName Ltd</cbc:RegistrationName>

<cbc:CompanyID schemeID="0089">GB983294</cbc:CompanyID>

<cbc:CompanyLegalForm>Private Limited Company</cbc:CompanyLegalForm>

</cac:PartyLegalEntity>

<cac:Contact>

<cbc:Name>John Doe</cbc:Name>

<cbc:Telephone>+449384203984</cbc:Telephone>

<cbc:ElectronicMail>john.doe@foo.bar</cbc:ElectronicMail>

</cac:Contact>

</cac:Party>

</cac:AccountingSupplierParty>| 1 | schemeID attribute is mandatory for electronic addresses, ie. EndpointID |

| 2 | schemeID attribute is mandatory for all party identifiers |

| 3 | VAT identifiers shall be prefixed with the country code |

7.3. Buyer (AccountingCustomerParty)

Buyer is mandatory information and provided in element cac:AccountingCustomerParty

<cac:AccountingCustomerParty>

<cac:Party>

<cbc:EndpointID schemeID="0002">FR23342</cbc:EndpointID>

(1)

<cac:PartyIdentification>

<cbc:ID schemeID="0002">FR23342</cbc:ID>

(2)

</cac:PartyIdentification>

<cac:PartyName>

<cbc:Name>BuyerTradingName AS</cbc:Name>

</cac:PartyName>

<cac:PostalAddress>

<cbc:StreetName>Hovedgatan</cbc:StreetName>

<cbc:AdditionalStreetName>Po box 878</cbc:AdditionalStreetName>

<cbc:BuildingNumber>32</cbc:BuildingNumber>

<cbc:CityName>Stockholm</cbc:CityName>

<cbc:PostalZone>45634</cbc:PostalZone>

<cac:AddressLine>

<cbc:Line>Third line</cbc:Line>

</cac:AddressLine>

<cac:Country>

<cbc:IdentificationCode>SE</cbc:IdentificationCode>

</cac:Country>

</cac:PostalAddress>

<cac:PartyTaxScheme>

<cbc:CompanyID schemeID="ZZZ">SE459837593701</cbc:CompanyID>

(3)

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID>

</cac:TaxScheme>

</cac:PartyTaxScheme>

<cac:PartyLegalEntity>

<cbc:RegistrationName>Buyer Official Name</cbc:RegistrationName>

<cbc:CompanyID schemeID="0183">39937423947</cbc:CompanyID>

(4)

</cac:PartyLegalEntity>

<cac:Contact>

<cbc:Name>Lisa Johnson</cbc:Name>

<cbc:Telephone>+4623434234</cbc:Telephone>

<cbc:ElectronicMail>lj@buyer.se</cbc:ElectronicMail>

</cac:Contact>

</cac:Party>

</cac:AccountingCustomerParty>7.4. Delivery Details (Date and Location)

Delivery details may be given at document level.

Place and date of delivery is recommended and should be sent unless this does not affect the ability to ensure the correctness of the invoice.

The delivery element contains information on name, address and delivery location identifier (cac:Delivery/cac:DeliveryLocation/cbc:ID) which may be used if the place of delivery is defined through an identifier. For example GLN (Global Location Number)issued by GS1.

| Important distinction between DeliveryParty and DeliveryLocation: DeliveryParty is the party that took delivery of the goods, while DeliveryLocation is the physical location to which delivery was made. DeliveryParty, being a Party element, may have an address associated with it. However this is the correspondance address of the party taking delivery, not the location of the delivery itself. |

<cac:Delivery>

<cbc:ActualDeliveryDate>2024-11-01</cbc:ActualDeliveryDate>

<cac:DeliveryLocation>

<cbc:ID schemeID="0088">7300010000001</cbc:ID>

<cac:Address>

<cbc:StreetName>Delivery street</cbc:StreetName>

<cbc:AdditionalStreetName>Building 56</cbc:AdditionalStreetName>

<cbc:BuildingNumber>2</cbc:BuildingNumber>

<cbc:CityName>Frederiksberg</cbc:CityName>

<cbc:PostalZone>2000</cbc:PostalZone>

<cac:Country>

<cbc:IdentificationCode>DK</cbc:IdentificationCode>

</cac:Country>

</cac:Address>

</cac:DeliveryLocation>

<cac:DeliveryParty>

<cac:PartyName>

<cbc:Name>Delivery party Name</cbc:Name>

</cac:PartyName>

</cac:DeliveryParty>

</cac:Delivery>7.5. References

Support for invoice verification is a key function of an invoice. The invoice should provide sufficient information to look up relevant existing documentation, electronic or paper.

| Any reference element should contain valid information, if you do not have a reference, the element should not be present in the instance document. |

The Invoice and Credit Note transactions supports the following references to existing documentation:

7.5.1. Purchase Order and Sales Order reference

The Purchase Order is conditional. If order reference exist, use that, else use Buyer reference (see Buyer reference).

The customer will issue an order with a unique order number. This unique Purchase Order number should be supplied as the order reference on the invoice.

If order reference is stated at header level, the order reference element on line level can be used to state the order line numbers.

A sales order is issued by the seller, confirming the sale of specified products.

| In the Invoice, both a Purchase Order and a Sales Order reference can be given, but an Invoice instance cannot have a sales order reference without the corresponding purchase order reference. If (and only if) Buyer has not provided a purchase order ID but Seller has provided a sales order ID, it is permissible and recommended to use the sales order ID to dummy out the mandatory purchase order field. In this case it is strongly recommended to also include buyer reference, to ensure that Buyer is able to process the invoice. |

<cac:OrderReference>

<cbc:ID>PO-998877</cbc:ID>(1)

<cbc:SalesOrderID>SO-12343</cbc:SalesOrderID>(2)

</cac:OrderReference>| 1 | Purchase Order reference |

| 2 | Sales Order reference |

7.5.2. Buyer reference

The Buyer reference, known as 'Your ref', is conditional. An Invoice shall have either the Buyer reference or the order reference (see Purchase Order and Sales Order reference)

The element is used for the reference of who ordered the products/services. Example being the name of the person ordering, employee number or a code identifying this person or department/group. 'Your ref' is often used for internal routing at the recipient and hence it is important to fill this element with the correct values according to the need of the recipient.

| When a reference is provided by the customer, this reference should always be used. |

If neither Buyer reference nor a reference to an order is supplied by the customer, the name of the person ordering or appointed for the customer can be supplied in buyer reference if known by the supplier.

| If Buyer reference is to a person in Buyer’s organization, Seller may provide the name or e-mail address of the person in question, or their employee ID (if known). Buyer shall undertake reasonable effort to identify the person in question in their organization, and shall not reject an invoice solely because Buyer reference is in the form of an e-mail or name, rather than an employee ID or other Buyer-provided reference. |

<cbc:BuyerReference>0150abc</cbc:BuyerReference>7.5.3. Invoiced object identifier

The invoiced object identifier is the identifier for an object on which the invoice is based, given by the Seller. Examples may be a subscription number, telephone number, meter point, vehicle, person etc., as applicable.

If it is not clear to the receiver what scheme is used for the identifier, a conditional scheme identifier should be used, that shall be chosen from the Invoiced object identifier scheme (UNCL 1153) code list.

The invoiced object reference is provided by using the element cac:AdditionalDocumentReference with the document type code = 130

<cac:AdditionalDocumentReference>

<cbc:ID schemeID="AKZ">DR35141</cbc:ID>(1)

<cbc:DocumentTypeCode>130</cbc:DocumentTypeCode>(2)

</cac:AdditionalDocumentReference>| 1 | Scheme identifier from Invoiced object identifier scheme (UNCL 1153) code list |

| 2 | Document type code shall be ´130´ to indicate Invoiced object, based on Document name code, full list (UNCL1001) code list |

Person reference (Ydelsesmodtager)

The European Norm specifies a “Invoiced object identifier” at document level and a corresponding “Invoice line object identifier” at line level.

This may be used to connect the invoice line to a census ID (CPR-number), in cases where it is important to connect a product or service to a particular physical person, who may or may not be covered by one of the available Party classes.

If the object of the invoice is not clear to the recipient, a reference to a code in the Invoiced object identifier scheme (UNCL 1153) code list must be provided.

To identify that they are the “mapped” from the European Norm object identifier, the DocumentTypeCode is set to “130” based on Document name code, full list (UNCL1001) code list.

| Invoices which contain a census ID (CPR-number) must be processed as documents containing confidential personal data covered by GDPR. Nemhandel eDelivery provides an envelope-level identifier that the transmitted document contains such data. This identifier must be used where applicable. |

<cac:AdditionalDocumentReference>

<cbc:ID schemeID="ARR">2211801232</cbc:ID>(1)

<cbc:DocumentTypeCode>130</cbc:DocumentTypeCode>(2)

</cac:AdditionalDocumentReference>| 1 | Scheme identifier from Invoiced object identifier scheme (UNCL 1153) code list and the indentifier value is a census ID (CPR-nummer) with 10 digits. |

| 2 | Document type code shall be ´130´ to indicate Invoiced object, based on Document name code, full list (UNCL1001) code list |

7.5.4. Contract reference

To reference or match an Invoice to a purchase contract or frame agreement, the contract number could be specified like this: